Easy Budget Planning

Our Budgets makes planning your budget a straightforward and enjoyable experience.

Simple 3 step process to create, analyze, and share a budget with anyone you choose (partner, housemates, or even your accountant) to achieve your financial goals as a team.

We think you'll find this so easy we wanted to release it FREE to use right now - no payment required.

Budget Together, Succeed Together

Our budgeting tool makes financial planning a shared responsibility for better results.

Collaborative Planning

Create budgets together. Everyone contributes their input for a more accurate and inclusive financial plan.

Seamless Budget Sharing

Share your budgets securely. Give access to others who need to view or contribute to your household financial planning.

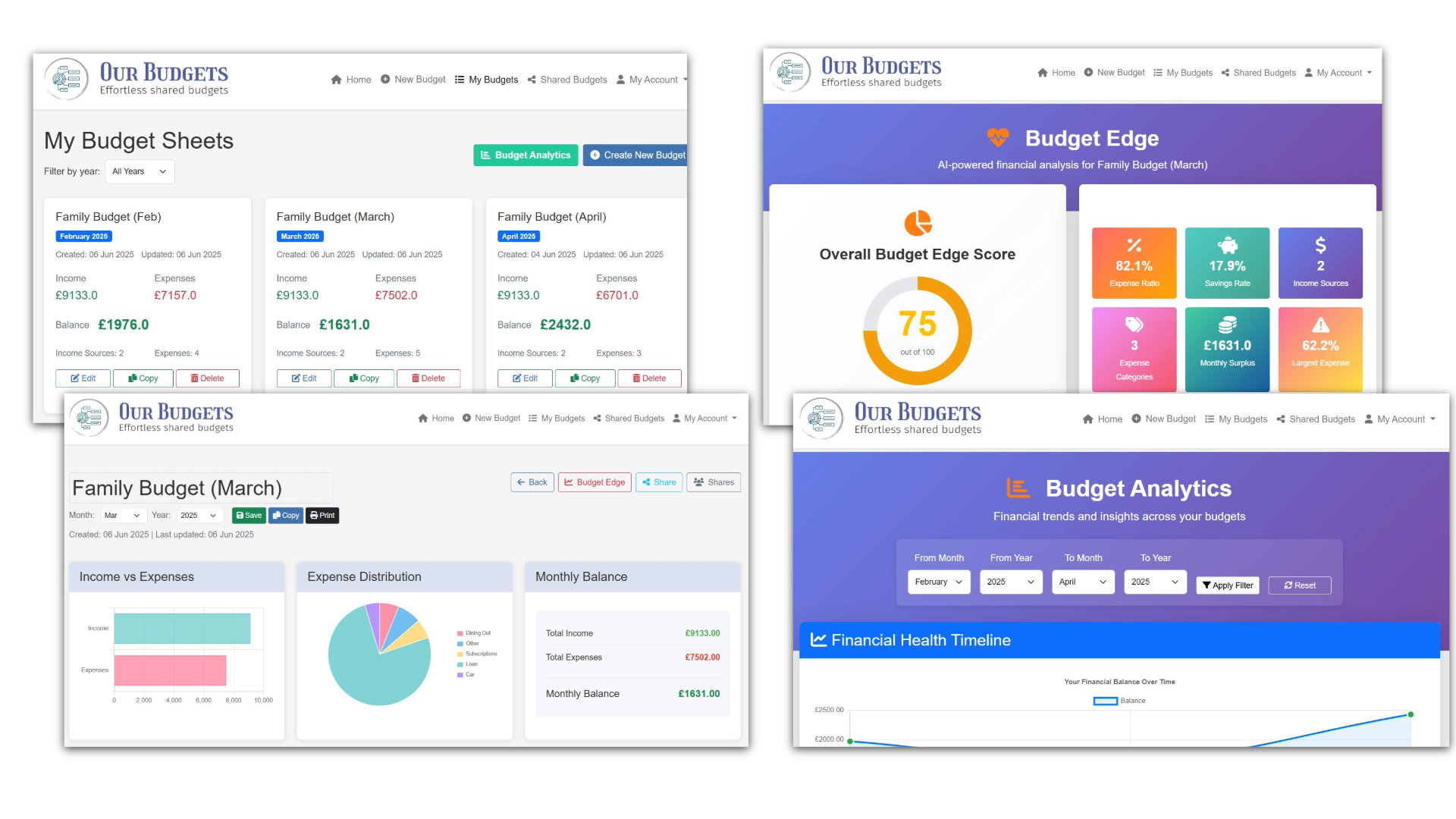

AI Budget Analysis

Use our Budget Edge AI analysis tool to really dig into you budget and give positive recommendations to improve your finances.

At Our Budgets Your Financial Privacy Is Protected

We believe budgeting should be simple and secure

No Bank Account Linking

We don't connect to your bank accounts. You manually enter only the information you're comfortable sharing.

No Banking Details Required

We never ask for bank details, account numbers, or passwords. Your sensitive financial information stays with you.

Secure & Private

Your budget data is encrypted and stored securely. Only you have access to your financial information.

Manual Entry Only

You control exactly what information to include. Enter only the budget categories and amounts you want to track.

How to Get Started

Creating your first budget is easy with our simple 3 step guided process.

Enter Your Income

Add all sources of household income, whether it's one person or multiple contributors.

Add Your Expenses

Input your regular expenses like rent/mortgage, utilities, loans, and subscriptions.

Customize Your Budget

Add custom expense categories specific to your household needs and tag them for better organization.

Review and Save

See your complete budget summary with income, expenses, and remaining balance, then save it for future reference.

Ready to Take Control of Your Finances?

Start planning your household budget today and secure your financial future.